The Impact of Economic Decisions by American Presidents Series

President Richard Nixon – Price Controls and Ending the Gold Standard

Most decisions by American presidents and other world leaders do not have an immediate impact on the economy, regarding the macroeconomics of employment and inflation, at least in the short term of their administration. For example, President Franklin Roosevelt’s bank holiday, President John Kennedy’s tariff on imported steel, and President Ronald Reagan’s Economic Recovery Tax Act had limited immediate effects on the economy but their long-term effects are significant. The accomplishments or problems of the previous administration will likely impact the administration that follows. For example, President Biden faced criticism about the economy in his administration but the steps taken to address them may not show results until years later. The drop in Real Disposable Income from the administration of President Trump is significant because it measures income after taxes and inflation.

| President | GDP Growth | Unemployment Rate | Inflation Rate | Poverty Rate | Real Disposable Income |

| Johnson | 2.6% | 3.4% | 4.4% | 12.8% | $17,181 |

| Nixon | 2.0% | 5.5% | 10.9% | 12.0% | $19,621 |

| Ford | 2.8% | 7.5% | 5.2% | 11.9% | $20,780 |

| Carter | 4.6% | 7.4% | 11.8% | 13.0% | $21,891 |

| Reagan | 2.1% | 5.4% | 4.7% | 13.1% | $27,080 |

| H.W. Bush | 0.7% | 7.3% | 3.3% | 14.5% | $27,990 |

| Clinton | 0.3% | 4.2% | 3.7% | 11.3% | $34,216 |

| G.W. Bush | -1.2% | 7.8% | 0.0% | 13.2% | $37,814 |

| Obama | 1.0% | 4.7% | 2.5% | 14.0% | $42,914 |

| Trump | 2.6% | 6.4% | 1.4% | 11.9% | $48,286 |

| Biden | 2.6% | 3.5% | 5.0% | 12.8% | $46,682 |

This series provides a context of important decisions by America’s presidents that are connected to the expected economic decisions facing our current president’s administration. The background information and questions provide an opportunity for small and large group discussions, structured debate, and additional investigation and research. They may be used for current events, as a substitute lesson activity or integrated into a lesson.

In the case study below, have your students investigate the economic problem, different perspectives on the proposed solution, the short and long term impact of the decision, and how the decision affects Americans in the 21st century.

The Economic Problem:

- The world’s economy collapsed as a result of World War I. The Bretton Woods Agreement provided stability with a fixed exchange rate of $35 U.S. dollars to an ounce of gold. The strength of the U.S. dollar and economy was good for the United States and other countries. In fact, the gold of most countries was at the Federal Reserve Bank in New York, so it was easy to physically move gold from one vault to another. The Marshall Plan provided $13.3 billion (about $175 billion in today’s money) to rebuild Europe. The Bretton Woods Agreement supported a global economy and international trade and cooperation.

- By 1960, the U.S. economy began facing new challenges from the Baby Boomers, national debt, Cold War, trade deficit, higher unemployment and inflation. Economists introduced new research on the economy. The ideas of John Maynard Keynes that were seen as helpful to the challenges of the Great Depression and World War II were questioned in the 1960s by Milton Friedman and Paul Samuelson and other economists who carefully followed the money supply in the economy. In response to the cost of the Vietnam War and the Great Society programs, in addition to the increased consumption of the Baby Boomers, the interest rate policy of the Federal Reserve Bank supported an increase in dollars.

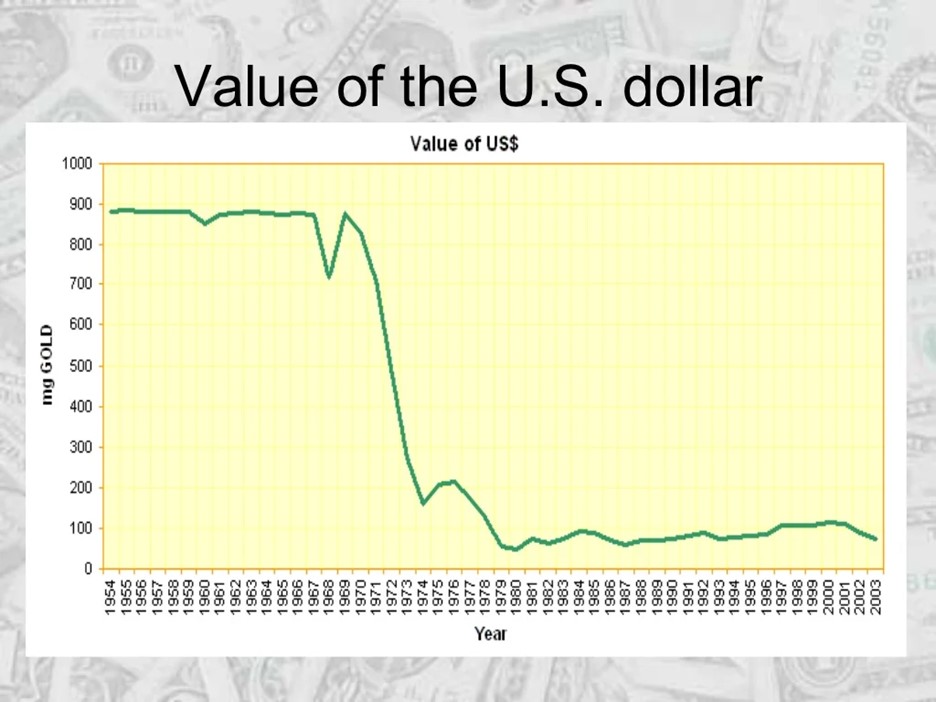

- President Richard Nixon understood the political implications of the U.S. economy. Although an inflation rate of 4.7% may not appear to be a concern, it is an increase of 50% from the expected rate of 3% and a GDP growth rate of 2%. When President Nixon became president ever nation wanted dollars. The amount of dollars in circulation increased to four times the amount of gold in reserves. As aa result the dollar was overvalued and very strong. This situation negatively impacted our balance of trade with other countries. In 1971, the United States reported its first trade deficit.

- As the supply of dollars increased over the quantity of gold, the United States Treasury feared that countries might ask for their gold and the United States would not be able to meet their demands. As inflation increases, the purchasing power of the dollar decreases. A simple solution would be to devalue the dollar but since it was pegged to gold at $35 an ounce, this was not possible. The situation became critical in 1971when Britain requested selling $3 billion dollars it had from a trade surplus for gold. The United States only had about $10 billion in gold and if other countries asked for gold, there would be an international crisis.

Activity #1 – The Strong Dollar:

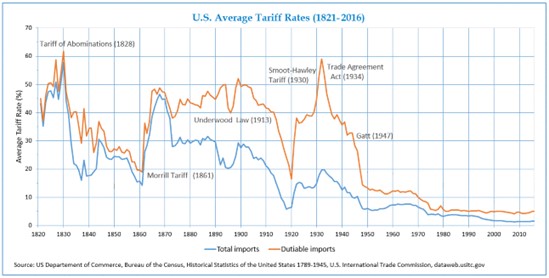

Examine the graph below for the years 1950-1970. Calculate the percent decline in the purchasing power of the dollar. How does a weaker dollar affect trade and the national economy? What are the advantages and disadvantages of a stronger and weaker dollar?

Activity #2 – The Weaker Dollar

Examine the data in this chart, especially for the years, 1960-1980. The amount of gold reserves (left axis) is constant but the value of the dollar changes. Which events in the 1960s likely affected the weakening of the U.S. dollar? Which decisions or events in the 1970’s contributed to the noticeable decline in the dollar. How does a weaker dollar affect the economy differently for consumers and investors?

Solutions to the Problem:

President Lyndon Johnson responded to the ‘small’ (18%) decrease in the value of the dollar in 1968 with a temporary (one-year) surcharge of 10% on income tax payments. The purpose of the additional tax was to reduce or stabilize the 3.0 percent rate of inflation. Even with the surcharge, inflation increased to 4.7% within the year. On August 25, 1969, the federal funds rate was at 9.75%, the highest level since World War 2, about seven percent above the GDP growth rate, and will cause an economic recession. The economic advisors, including Arthur Burns, Chairman of the Federal Reserve Bank, informed Nixon that the traditional monetary and fiscal policy tools were not working, President Nixon extended the tax surcharge through 1970. With the presidential election in 1972, Nixon knew that he needed to control the rising rate of inflation and avoid causing a recession.

President Nixon called for a secret meeting at Camp David to address this problem. He knew that politically the need to make a bold decision, like FDR with the decision to close the banks in March 1933. He also wisely sought the perspectives of economists with different points of view.

On August 15, 1971, President Nixon addressed the nation from the Oval Office with his historic decision, Executive Order 11615:

- Wage and price controls for 90 days

- Ending the Bretton Woods Agreement on converting dollars to gold

- 10% surcharge tax on tariffs

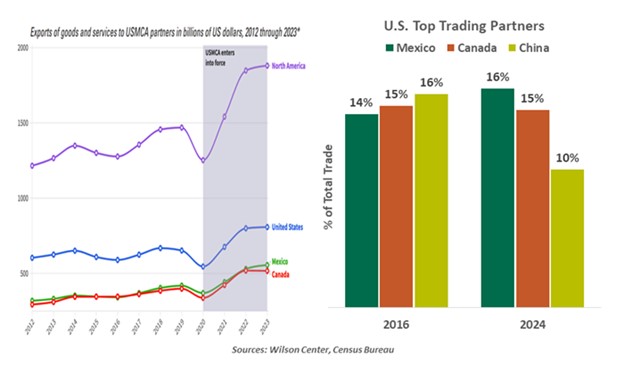

The Fed Funds rate in August 1971 was at 5.75% about three percent higher than the GDP rate of growth. One of the objectives of the “Nixon Shock” was to force other countries, especially China, to revalue their currencies to allow for a competitive free trade market for the United States. The stock market jumped 4% on August 16, but the decision to allow gold to be bought and sold at the market would lead to an unexpected increase in the price of oil. The wage and price controls and tariff surcharge were lifted by the end of 1971 but making the U.S. dollar the reserve currency of the world had lasting implications for the economy. President Nixon won the 1972 election by a landslide but the negative effects of then Nixon Shock would return in 1973.

Activity #3 – Interviews/Oral History:

Invite students to interview senior citizens who will have different perspectives as investors, bankers, union workers, homeowners, etc. on the “Nixon Shock.” For example, I was a high school teacher in New York City earning $5,500 a year. Prices were high from inflation and I was looking forward to a 20% salary increase, about $1,000, on September 1, 1971. My 1969-70 salary was frozen as was the pay scale for another year. In 1973, the price of gasoline increased from 39 cents a gallon to more than 60 cents and gas was rationed. Although the energy crisis was the result of an embargo by OPEC against the United States for our support of Israel in the Yom Kippur War. After the embargo was lifted the higher cost of energy continued contributing to unemployment and continuing inflation. This became known as stagflation.

Activity #4 – The Popularity of Credit Cards:

Gather information about the new technologies of how credit cards, money markets, and currency swaps increased personal spending, consumption, and the velocity of money.

- How did the banking industry change to ‘create’ new money in the economy?

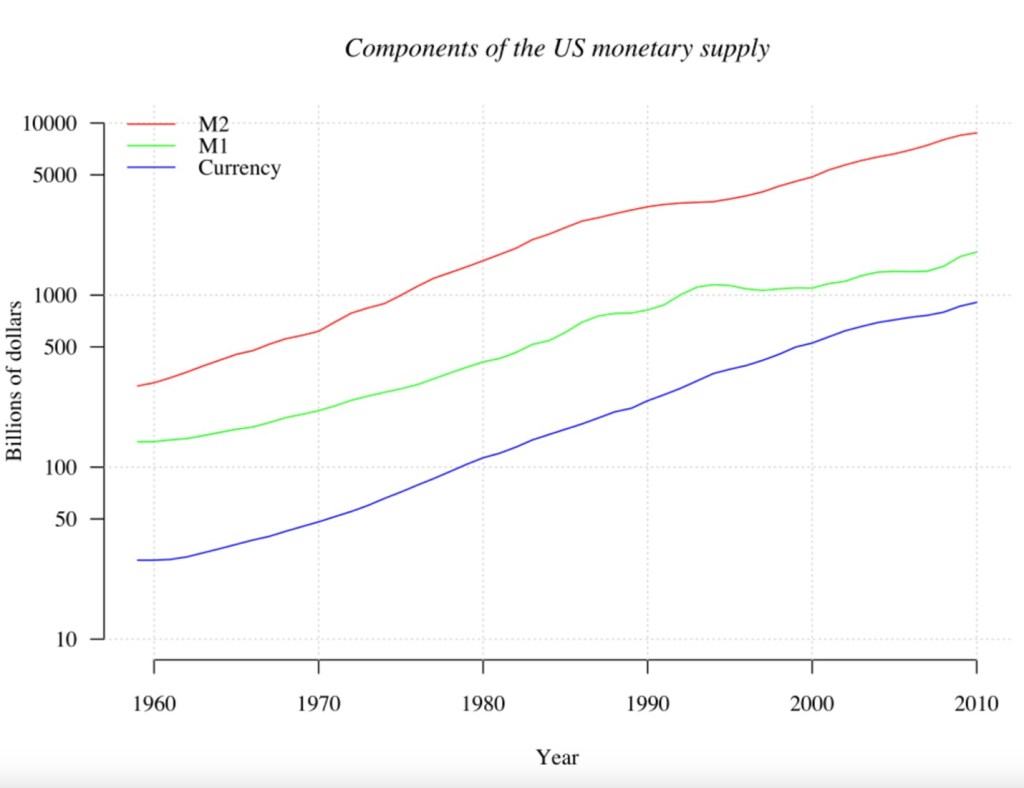

In the chart below, currency represents coins and dollars, what we call cash.

M1 money represents currency plus money in a checking account which can quickly be exchanged for cash.

M2 money represents money that requires going to the bank tor waiting more than one month to convert the money to cash. (i.e. certificate of deposit)

- Calculate the slope of the graph in dollars and also by the annual percentage change.

- How did this contribute to inequality, consumer debt, and inflation?

- What is the difference between installment credit and revolving credit?

- How did the credit card change our standard of living?

- What were the consequences of higher unemployment and full employment?

- How did two income households affect the supply of money?

The Evolution of Consumer Credit in America

Activity #5 – Worker Productivity:

- What information is provided in the graph?

- What are several reasons for an increase in productivity by workers?

- How can high school students become more productive in their social studies class? (i.e. better grades, complete additional assignments and projects)

- Should a worker be paid on the amount of work they produce or on the wage they agreed to when they were hired? Should a teacher be paid based on the output (grades) of the students in their classes?

- Why do the red and blue lines diverge after 1970? Why is there a significant gap between what workers are producing in one hour and what they are paid?

How did taking the U.S. Dollar off the gold standard affect the economy?

The immediate impact of separating the value of the dollar from a fixed exchange rate of $35 was that the new value increased by 10% to $38 an ounce. It took about four years for the global economy to stabilize and accept dollars as the reserve currency (or safety net) in the event of a crisis. The supply of gold increased significantly after 1971 with about half of the current supply of gold being mined since the ‘Nixon Shock’.

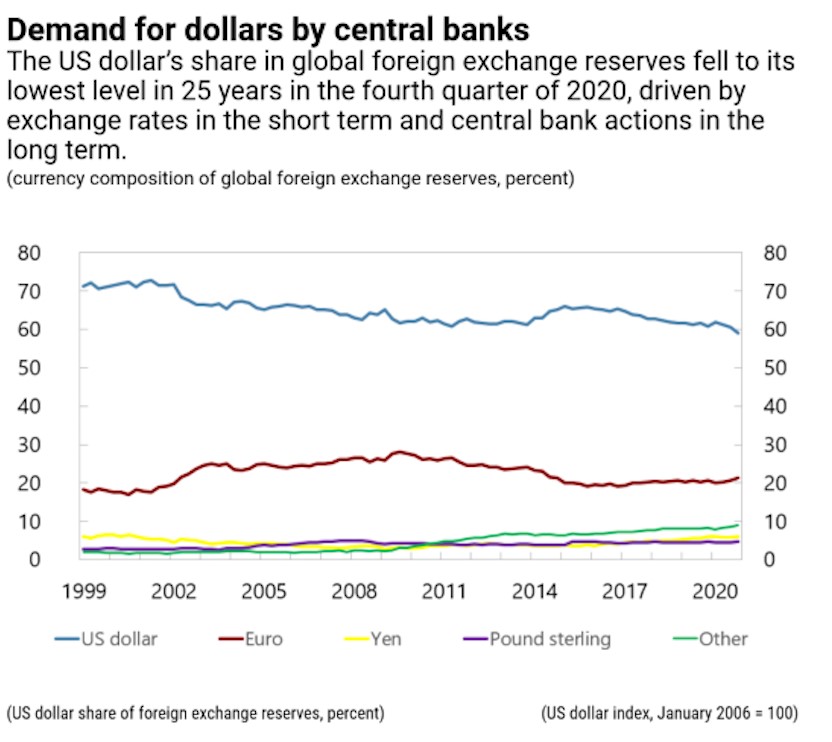

- How do countries buy dollars? How does this affect our economy?

Major Foreign Holders of U.S. Treasury Securities as of April 2024

- Is it possible for foreign countries to have too many U.S. dollars?

- How would the decision of other countries to adopt a different currency affect the economy of the United States?

- If a group of countries made a secret agreement to sell their U.S. dollars in a short period of time and purchase euros or the renminbi instead, how would the United States economy be affected?

- What is the future of the dollar as the reserve currency? Does the United States have more advantages than disadvantages of being the dominant economic power in the world? The Dollar: The World’s Reserve Currency